For extra details about Expert Assisted, refer to the QuickBooks Phrases of Service. Rick is a highly achieved finance and accounting skilled with over a decade of expertise payroll quickbooks desktop. Specializing in delivering exceptional value to businesses, Rick navigates the complexities of the financial realm simply. His experience spans numerous industries, consistently offering correct insights and recommendations to support informed decision-making.

Luckily, QuickBooks presents directions proper on the web page, thereby making the software very seamless to make use of. This step wants information like a check number, check date, tax withholdings, worker pay, and so forth. For all those staff who had been paid within the present year, their information should be added sufficient. If you pay your specific staff for the very first time, then this part isn’t for you. Earlier Than sending payroll data, it’s crucial to evaluation and approve it to ensure accuracy. QuickBooks Desktop sometimes provides a abstract of the payroll details, including whole payroll expenses and the number of employees paid.

- In Accordance to a report by QuickBooks, greater than 34% of enterprise house owners nonetheless use spreadsheets to handle their payroll manually.

- Add, handle, and pay as many employees as your corporation requires without additional limitations.

- In addition to sending payroll information to your employees, you should also send payroll tax data and funds to the appropriate tax businesses.

- If you’re already locked into the QuickBooks system, it may be worth including payroll companies simply to keep issues cohesive.

- A payroll processing guidelines is a software that helps ensure correct and compliant payroll.

Firstly, you want to guarantee that you have a couple of particulars handy, similar to basic worker particulars, their deductions, pay schedules, Form W-4s, and pay charges. Then, you have to open the QuickBooks Payroll setup from the Worker menu. Automated payroll and time-tracking instruments can cut back the time to process payroll. One cause is that the majority payroll processing solutions calculate payroll taxes for you, which might take some time if accomplished by hand.

Voluntary deductions—such as medical insurance premiums, retirement plan contributions, or wage garnishments—are additionally subtracted. For example, if an worker earns $2,000 in gross pay however has $500 in mixed deductions, their internet pay could be $1,500. As Soon As you return to the payroll service, you could have to arrange payroll all over again. Payroll data, together with worker info and tax setup, also wants an intensive evaluation after you renew QuickBooks Payroll subscription.

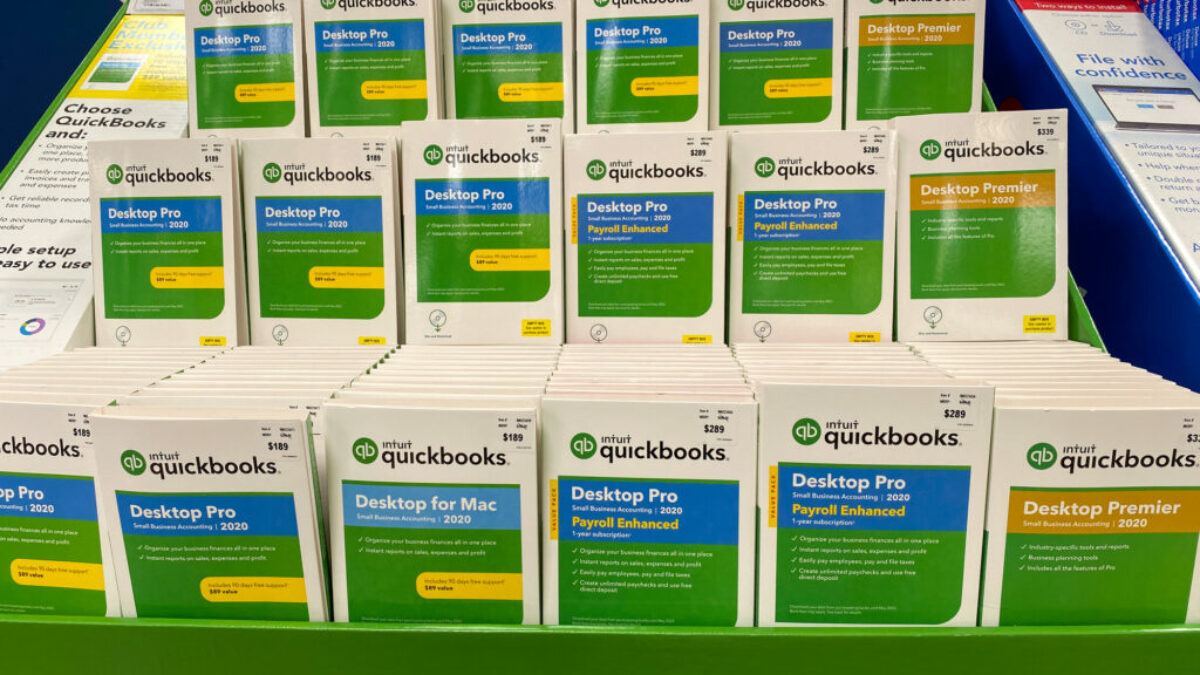

This additionally helps them make the most of the full potential of QuickBooks payroll options, optimize their payroll process, preserve accuracy, and save time. This blog aims to provide detailed info on how to arrange payroll in QuickBooks in compliance with payroll rules. At Present, QuickBooks is taken into account probably the greatest tools that millions use to raise their businesses and make their accounting tasks seamless. In this article, you’re going to get a step-by-step information to learn to set up payroll in QuickBooks Desktop, what sort of business ought to arrange payroll, and the method to run your payroll.

How Do I Reactivate My Quickbooks Payroll Subscription?

This ensures compliance with recordkeeping requirements and provides documentation in case of audits or disputes. That means evaluating your payroll reports against your bank statements, general ledger, and tax filings to make sure everything adds up. This step helps catch any errors—like duplicate funds or incorrect tax amounts—before they snowball into greater problems. It’s a good behavior to get into on the end of every payroll cycle, especially if you’re managing issues manually or across a number of platforms. Once you approve all your worker time cards, you’re ready to run payroll and problem funds. Approval is one of the most important steps when running payroll for workers.

The Proper Method To Reactivate Payroll Subscription Quickbooks Desktop

Learn how to get started with QuickBooks Desktop Payroll and begin paying your workers with these quick step-by-step movies. If you don’t plan payroll accurately, it can lead to cash shortages and monetary strain. Here’s how payroll impacts cash flow and what you are able to do to maintain issues working easily. FICA requires employers and workers to contribute to Social Security and Medicare. Every pays 6.2% for Social Safety and 1.45% for Medicare, adding up to 15.3%.

Key Features Of Quickbooks Payroll

Keeping issues organized now will prevent time and stress in relation to quarterly or year-end filings. It also helps you rapidly resolve any points if an worker spots an error on their pay stub or has a query about past wages. Pay stubs give your workers a clear breakdown of their pay, including gross wages, tax withholdings, deductions, and web pay.

This is a half of the company’s push to move everybody to QuickBooks On-line, a lot to the disappointment of companies preferring to have full management over their knowledge. Marshall Hargrave is a monetary author with over 15 years of experience https://www.quickbooks-payroll.org/ spanning the finance and investing fields. He has expertise as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and Nationwide Enterprise Capital Association. Marshall is a former Securities & Exchange Commission-registered funding adviser and holds a Bachelor’s diploma in finance from Appalachian State College. As Quickly As that is in place, you’re prepared to begin collecting employee information. Now, let’s proceed to setting up firm contributions in QBDT payroll.

However the nice half is you could choose a 30-day free trial before making any long-term commitment. If you employ QuickBooks Desktop Payroll Enhanced, you can even set up to pay your payroll taxes electronically. In this task, you presumably can choose from a preset list of pay items, insurance coverage advantages and retirement deductions, or you can set up buyer items. If you provide your employees paid vacation and/or sick time off, you’ll have the ability to add these too. QuickBooks Desktop Enhanced Payroll is an included service for QuickBooks Enterprise Gold and Platinum customers.

Payroll is amongst the largest bills for many companies, so monitoring it precisely is key to budgeting and money move management. When you have a transparent picture of wages, taxes, and advantages, it’s simpler to plan forward and maintain your finances in check. We hope the above article shall be very useful in tax funds and the submitting companies but in case you find any difficulty then you probably can call us. Our expert group will help you in resolving your problem and in tax payments and filing also. You could make payroll reports, create paychecks, and pay employees by direct depositing or checking utilizing any of these three versions of QuickBooks Desktop Payroll.